EVENT CALENDAR Check out whats happening. Reach is the Best Accounting Software in India.

An Introduction To Malaysian Gst Asean Business News

GST Tax Goods and Services Tax.

. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. The scope of SST is relatively narrower which suggests it could only provide RM23bil in the form of annual tax collection.

Melayu Malay 简体中文 Chinese Simplified A Guide on Closure of Company Members or Creditors Voluntary or Compulsory Winding-up in Malaysia. AGENCY Browse other government agencies and NGOs websites from the list. Welcome to the 2019 edition of Guide to VATGST in Asia Pacific an essential reference for a.

Its purpose is to replace the sales and service tax which has been used in the country for several decades. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. In general they are.

Starting January 1 2022 several key amendments in the goods and services tax GST regime will be implemented. Besides extending the scope of e-invoicing rules. Other specifically listed transactions are also out of the VAT application scope eg.

Although GST helped the Malaysian government to collect RM44bil for the country this type of tax wasnt people-friendly in many ways. In the case of a taxable person VAT number holders input VAT on purchases of goods and services related to business activity generally is allowed for recovery. GST numbers for Indias GTSPL Division and.

Ram Chander Rai relied on several constitutions Judgments of the Honble Apex court one of which was Umaji Keshao Meshram and Ors. Out of the total projected agritech market potential of US24 billion the supply chain technology and output markets segments have the highest potential in India worth US121 billion followed by financial services US41 billion precision agriculture and farm management US34 billion quality management and. Companies can be closed down either by Striking Off or Winding UpLiquidation.

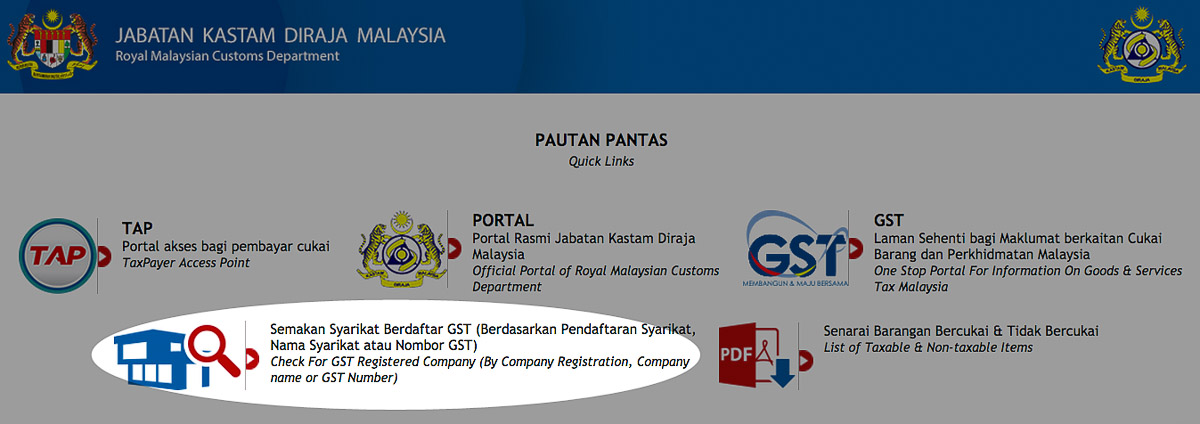

We list key GST changes in India for 2022 which impact the scope of supplies and enforcement mechanisms withdraws concessions introduces input credit restrictions etc. A goods and services tax in Malaysia GST a value added tax was scheduled to be implemented by the government during the third quarter of 2011 but the implementation was delayed until 1 April 2015. Customers who wish to have their purchases left outside the homeoffice HP Now shall not be liable for any damage or missing items.

Transfers of money transfers of business parts. Value Added Tax VAT and Goods and Services Tax GST systems across 17 countries in the Asia Pacific. Tax is rarely out of the news these days with the focus primarily on direct taxes.

The GST used to cover a wider sector and included almost every business. The district court of the district in which a person resides or is found may order him to give his testimony or statement or to produce a document or other thing for use in a proceeding in a foreign or international tribunal including criminal investigations conducted before formal accusation. For all normal orders there is a cancellation charge of Rs 5000 incl.

With the massive scope and scale of oil and gas operations and the thousands of assets involved in extracting hydrocarbons warehousing is a critical part of the value chain. This post is also available in. Scope Powers and Difference between Article 226 and Article 227 The Honble Supreme Court in the case of Surya Devi Rai vs.

There are no translations vailable. India Indonesia Japan The Laos Malaysia GST State VAT. COMPLAINT.

Growing segments within agritech in India. Radhikabai and Anr which laid down scope power and differences between. For all bulk orders there is a cancellation charge of Rs 20000 incl.

Receive your shipments faster and find out how much you will pay before shipment with Aramex import express services. To remain future-proof members and the accountancy profession must evolve and continue to embrace best practices and technology to leverage on the opportunities emerging from major developing trends such as climate change ESG and sustainability in line with the. Transfer of business as a going concern.

The order may be made pursuant to a letter rogatory issued or. Winding up and striking off both result in a company ceasing to exist. Scope and Charge.

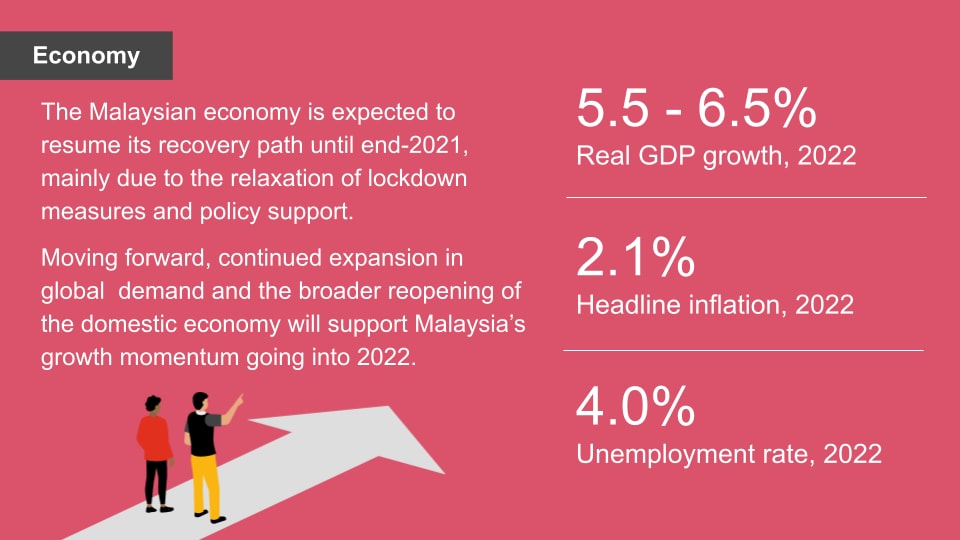

Malaysia and the world are preparing for a post-pandemic recovery even as the virus continues to mutate. GST is not chargeable on exempt supplies of which there are two categories sale and lease of residential land. Our Accounting Software is used by 1000 customers.

GST Treatment on Government Services. Out of scope supplies refers to supplies which are outside the scope of the GST Act. Menerima dan menghantar bungkusan pos boleh dibuat di Pusat Mel Kurier Lapangan Terbang Antarabangsa Kuala Lumpur PMK KLIA dan di mana-mana pejabat Pos Malaysia Berhad PMB yang mempunyai pejabat Kastam bagi memproses pelepasan Kastam ke atas barangan pos mengikut zon tertentu bagi mel-mel yang diterima.

Number of UN Member States are 193 and out of the 193 only 41 Member States do not implement VATGST as follows. Input tax incurred in making exempt supplies is not claimable.

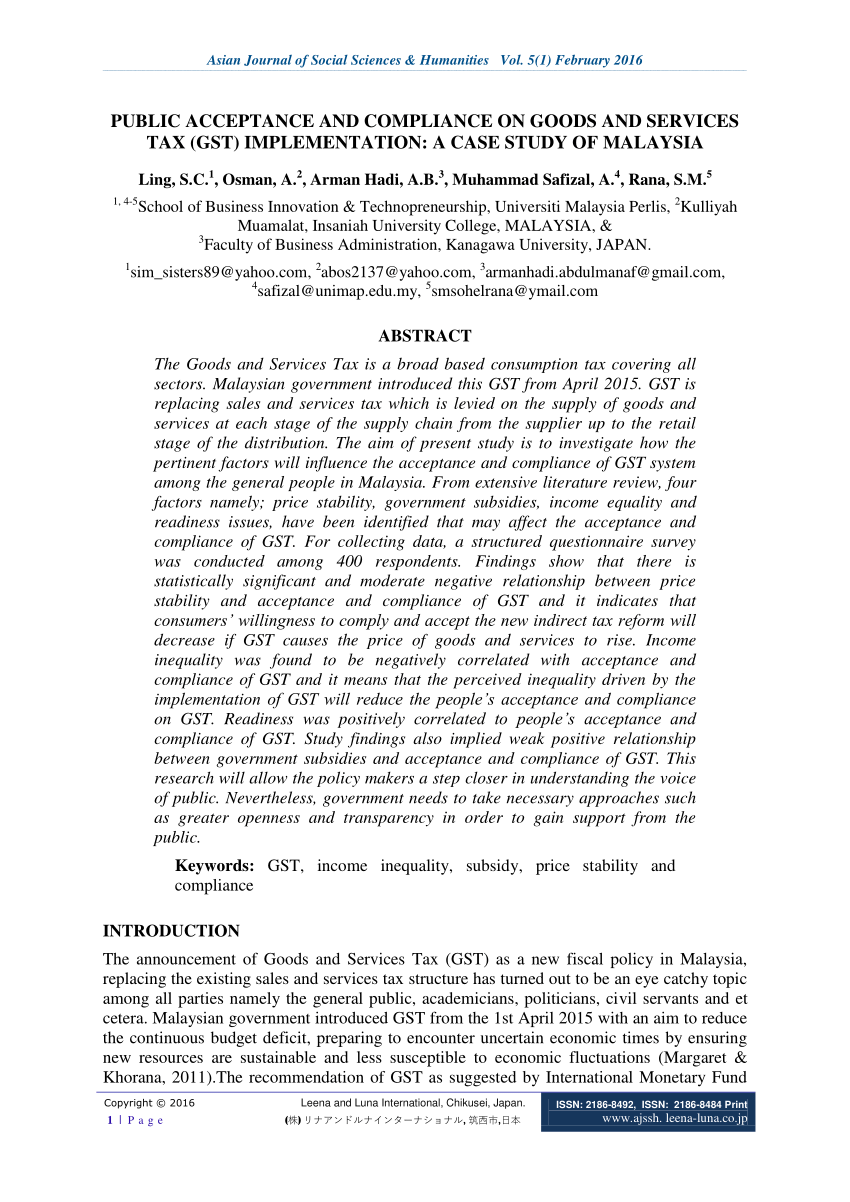

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia

Gst In Malaysia Will It Return After Being Abolished In 2018

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

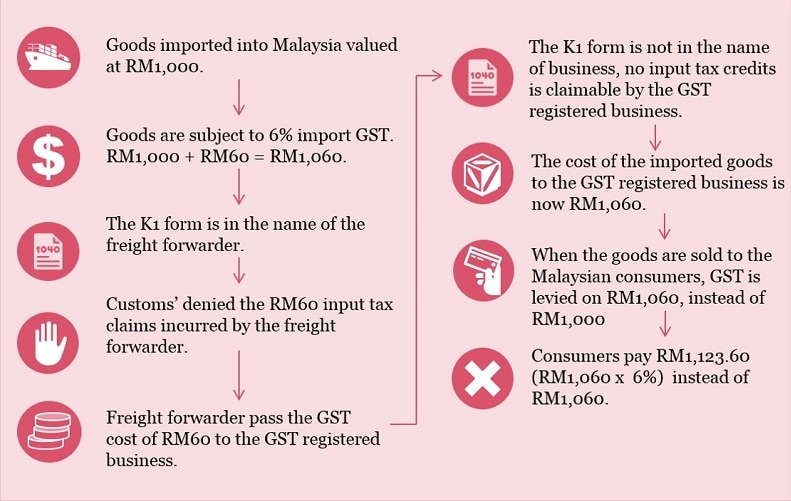

Are We Entitled To Credit For Gst On Importation Of Goods

Explore South India At An Amazing Rates To Book Your Package Login To Www Orchidglobal Net Southindia Orchidglobal India Travel Agent Kodaikanal Travel

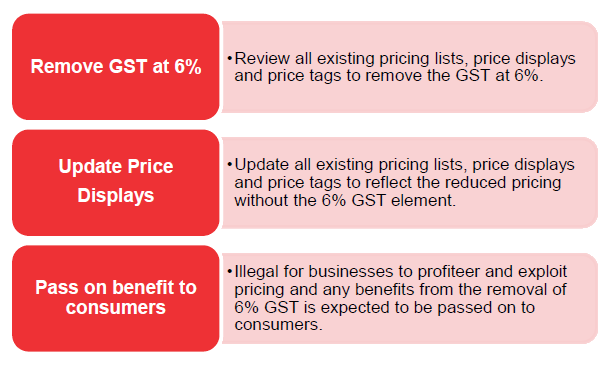

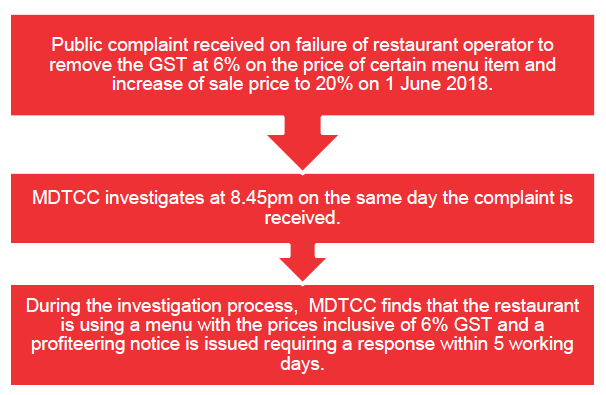

Anti Profiteering Laws In Malaysia Zerorisation Of Gst Leading To Greater Scrutiny On Pricing Lexology

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

About Service Tax Sales Tax Gst Customs Duties Special Tax Incentives In 2022 Voluntary Disclosure Amnesty

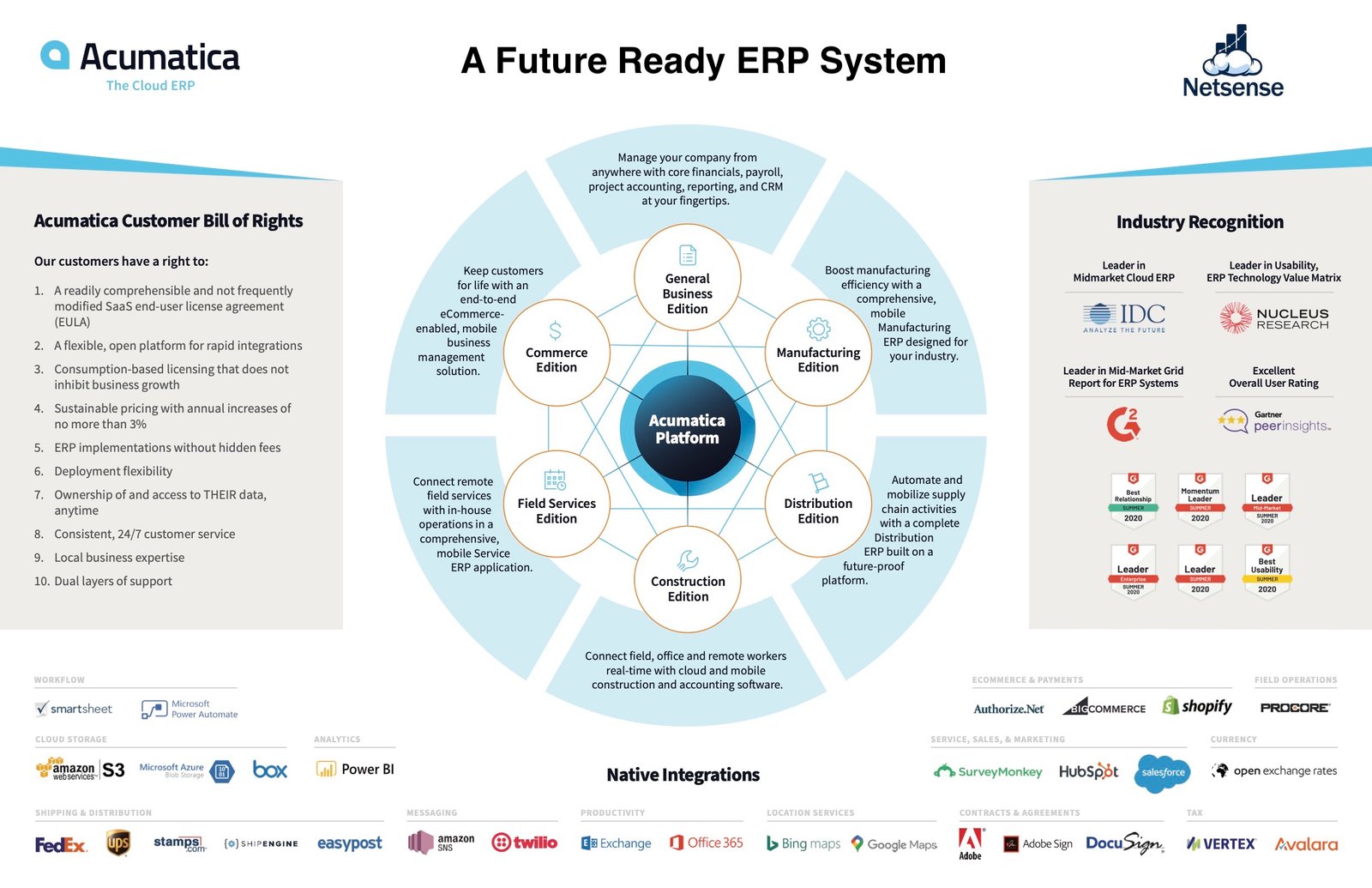

Acumatica Erp System Crm Software Malaysia Cloud Erp Solutions

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Anti Profiteering Laws In Malaysia Zerorisation Of Gst Leading To Greater Scrutiny On Pricing Lexology

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Gst Treatment Disbursement Reimbursement Gst Treatment Disbursement Reimbursement Recovery Of Expenses 1 Invoice In Own Company Name Reimbursement 6 Gst 2 Invoice In Client S Name By Gst Malaysia Facebook

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note